About Health Plans - Human Resources University of Michigan

The 15-Second Trick For What is Major Medical Insurance? - ValuePenguin

If you are 30 or older, you must receive a difficulty or affordability exemption to register in a Catastrophic strategy. The marketplace must verify, based on the data you provide, that you can not afford routine health protection. You typically only certify during the months of your challenge, plus the month before and the month after the challenge period.

If you are eligible, the available Catastrophic programs will show when you compare strategies in the market. What are the costs associated with Catastrophic plans? The monthly premiums for a Catastrophic strategy depend upon the candidate's situation. Although the premiums are usually low,. Before Click Here For Additional Info pick a Catastrophic strategy, check to see if you receive a based upon your income.

Major Medical Health Insurance - Health eDeals

For 2020, the deductible for all Catastrophic strategies was $8,150. After you meet the deductible, your insurance business spends for all covered services, without any copayment or coinsurance. What does a Catastrophic plan cover? Catastrophic plans cover the exact same necessary health benefits as other marketplace strategies. And, like other plans, Catastrophic prepares cover particular preventive services at no expense.

Delray Beach health insurance agents sell HMO, PPO, Dental & Major medical insurance

These check outs are exempt to the deductible. How do I buy significant medical insurance coverage? If you need to buy significant medical insurance by yourself, you can apply through the Medical insurance Marketplace or your state insurance exchange. Or, you can work straight with an insurance broker or company to purchase an "off-exchange" plan.

All about Health Plans and Benefits - U.SDepartment of Labor

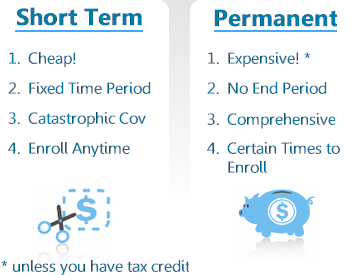

Examine first to see if you certify for either of these benefits prior to deciding where to purchase your health insurance coverage. To utilize the marketplace or an insurance coverage exchange, you must reside in the United States and be a citizen or a legally present citizen. You must use throughout an open registration duration, which typically runs from Nov.

15 of a given year. You can apply under a special enrollment period if you have a qualifying life event, such as: Losing health coverage Moving Marrying Having a baby Embracing a kid Levels of plans in the Health Insurance Marketplace include Bronze, Silver, Gold and Platinum. These "metal levels" are not associated with the quality of care but are based upon how you and your insurance coverage plan share expenses (what your insurance business pays versus what you pay in deductibles, coinsurance or copays).